Bon Secours Mercy Health Foundation now offers donor-advised funds

What Is a Donor-Advised Fund?

A donor-advised fund is like a philanthropic savings account that you put money into now for future giving. To establish your fund, you can make an up-front charitable contribution of cash to Bon Secours Mercy Health Foundation (BSMHF). Or you can give appreciated assets, like stocks. Either way, you'll receive an immediate tax deduction for your contribution.

With your donor-advised fund, you can recommend distributions to your favorite 501(c)(3) charities at any time, as long as the organization aligns with Catholic social teachings. The Foundation manages all funds according to Catholic guidelines for socially-responsible investing. Growth of investments in your fund is tax-free, increasing available funds to sustain your charitable giving over time.

If you donate to BSMHF and other nonprofits every year, a donor-advised fund may be a good choice for you. Use the "Fact Sheet" button to download an informational print-out, or keep reading below. Use the "Application" button to download an application that you can print out or fill in using your computer.

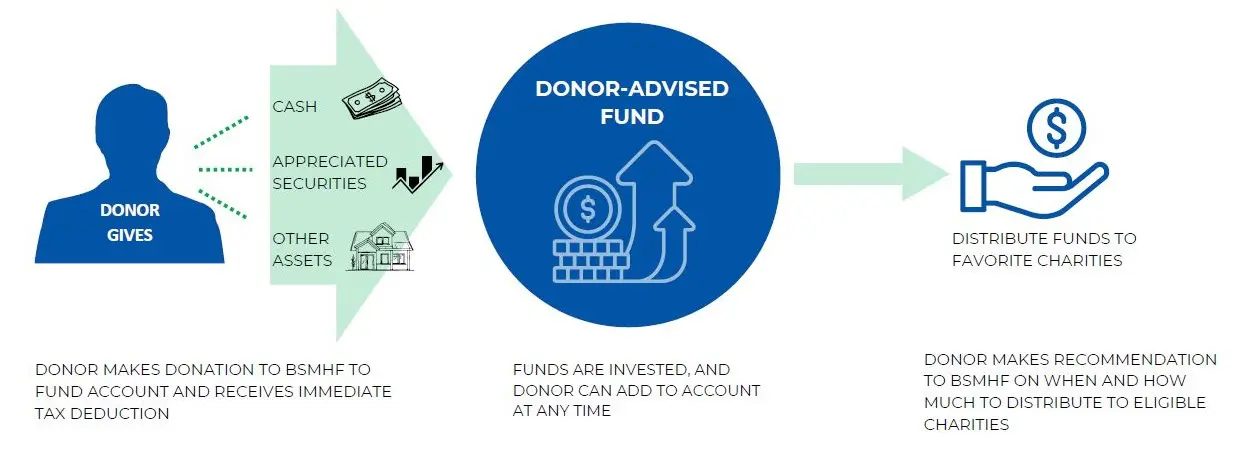

How It Works

-

You make a donation to your BSMHF fund account and receive an immediate tax deduction

-

That donation gets invested; you can add to your account at any time

-

You make recommendations to BSMHF on how much, and when, to distribute those funds to eligible charities

Benefits

Immediate tax deduction

No capital gains tax on gifts of appreciated assets

Tax-free growth on investments in your fund

Fees & Minimums

Minimum to open: $5,000

Minimum distribution: $100

Fees: 0.5% quarterly administrative fee

FAQs

Q: Who can contribute to a donor-advised fund?

A: Generally, any individual or entity (such as corporations or family foundations) can establish and contribute to a donor-advised fund.

Q: Are there any limitations on how funds can be used?

A: Distributions from a fund can only be made to 501(c)(3) organizations. Funds cannot be used for personal benefit, or political activities and must be in alignment with Catholic social teachings. Additionally, the donor cannot receive any goods or services in return for contributions. Distributions cannot be made to charities that support any of the following: abortion, contraception, embryonic stem cell research, racial or gender discrimination, pornography, arms production or assisted suicide.

Q: Can I choose which charities to support through my donor-advised fund?

A: Yes! One of the primary features of a donor-advised fund is that donors have the freedom to recommend distributions to a wide range of qualified charities. All distributions recommendations are subject to review and approval by BSMHF.

Q: Is there a minimum contribution or distribution amount?

The minimum contribution to establish a donor-advised fund is $5,000 and the minimum distribution from your fund is $100.

Q: How do I recommend a distribution from my donor-advised fund?

Once your donor-advised fund is established, you can submit distribution requests online through your donor portal or by contacting BSMHF staff.

6. Can I change my mind once I establish a donor-advised fund?

No, all donations to the donor-advised fund once created are irrevocable and cannot be returned to the donor.

7. What happens to the donor-advised fund upon my death?

You can name a Successor to serve as primary advisor of the donor-advised fund in the event of your death, incapacity, refusal or inability to serve.

8. Are there fees involved with the donor-advised fund?

We assess a 0.5% administrative fee on a quarterly basis based on your account's average beginning and ending balance for the quarter.

Contact Us

For more information, send us an email at DAF@bsmhealth.org

CLICK ARROW TO OPEN EMAIL